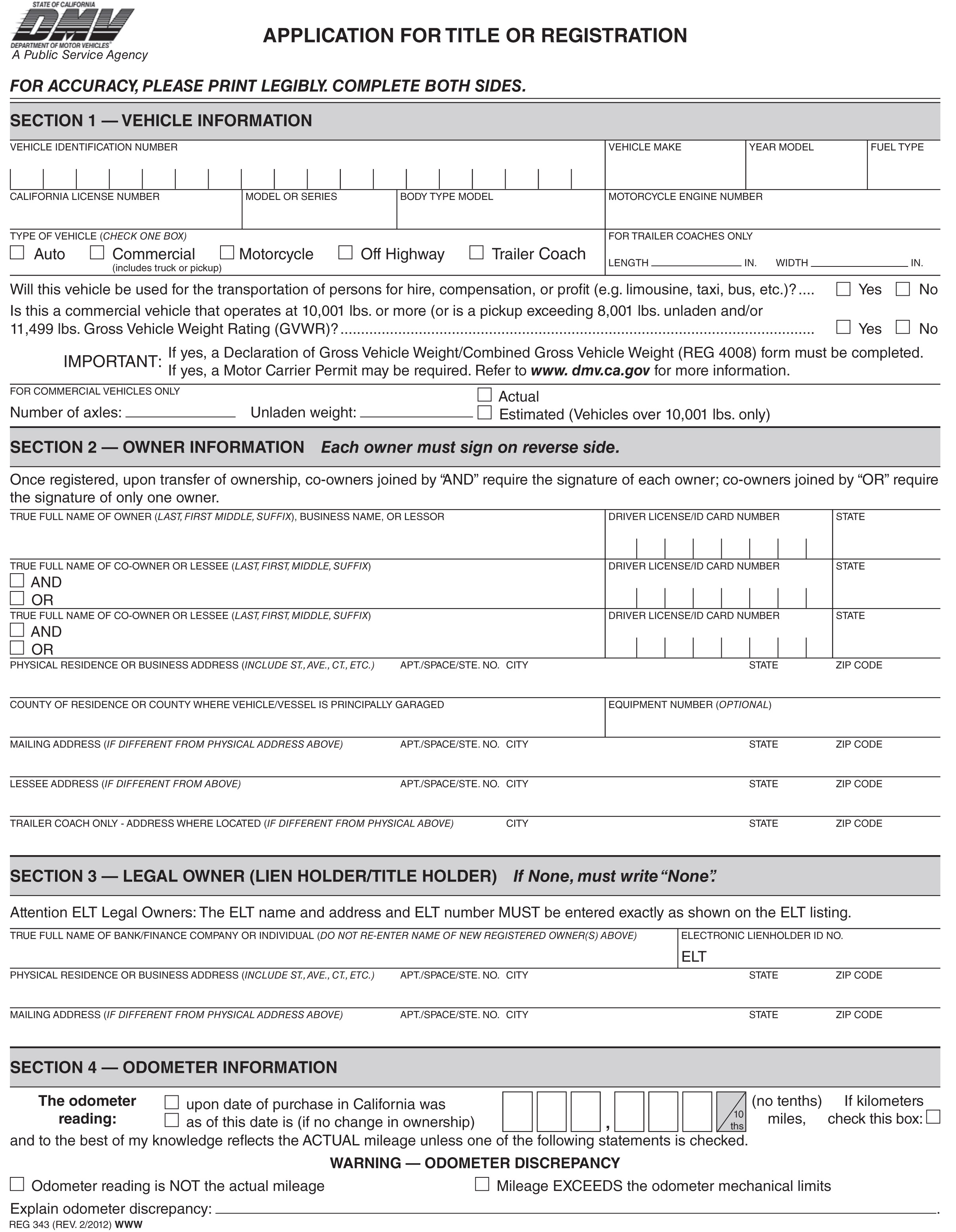

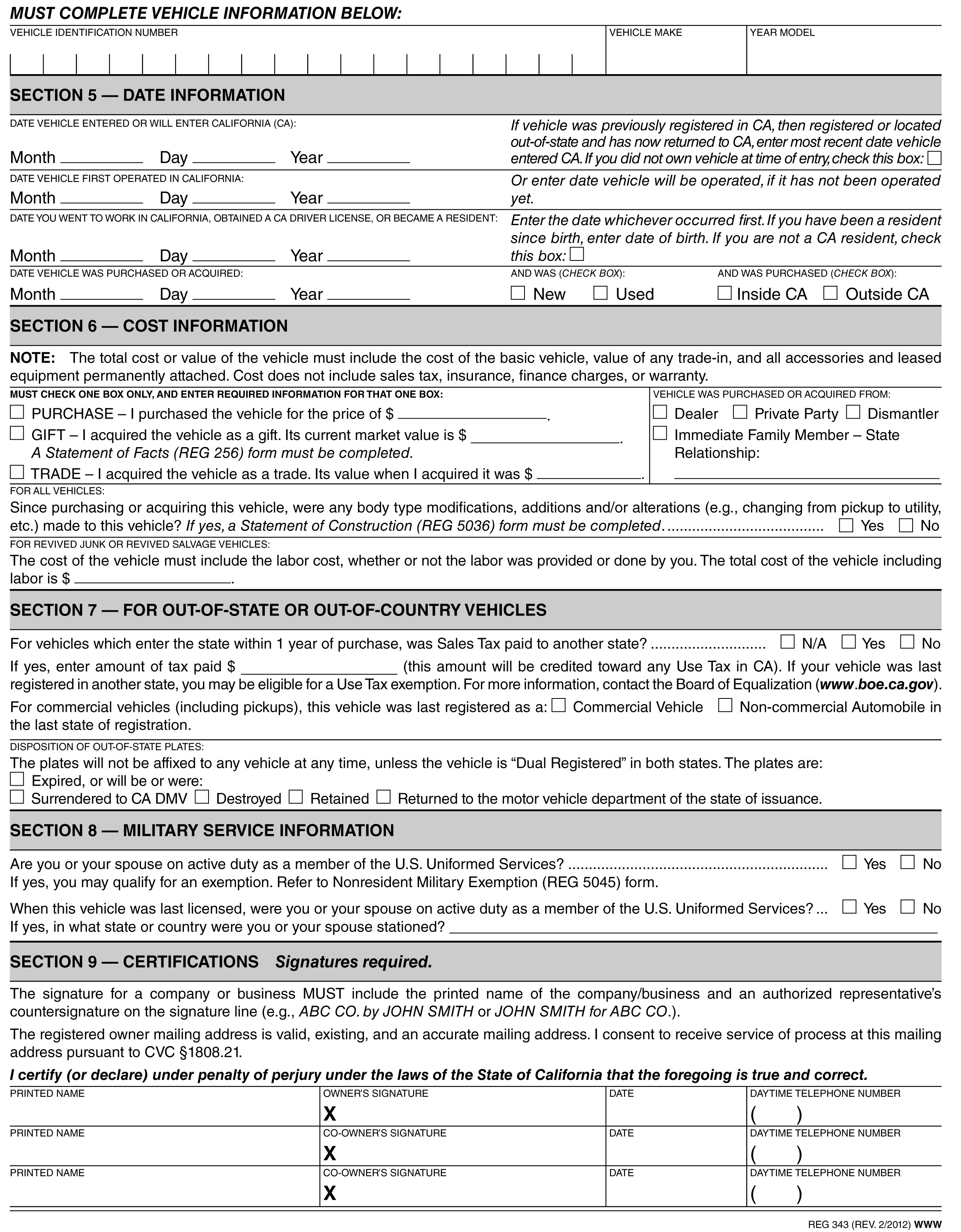

Step 1: Check With DMV For Bonded Title Qualification

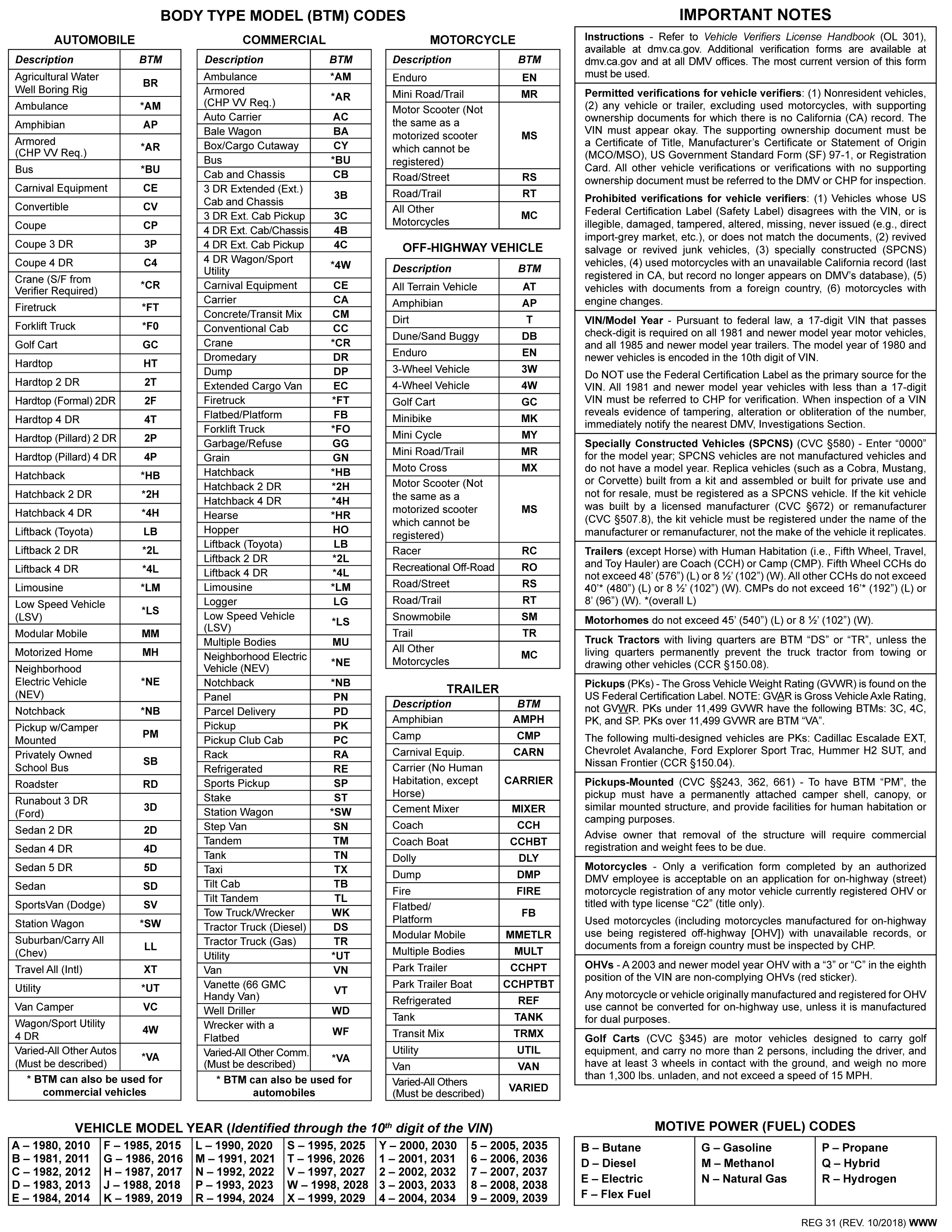

Some of the steps below might be different based on your situation. But first, complete an Application For Title or Registration. Then contact the California DMV and explain your situation and why you do not have a title. Then ask if you qualify for a bonded title. If they say yes, take your Application For Title and Registration form with you to the next step.

Step 2: Verification of Vehicle

Have an authorized DMV employee or law enforcement office complete a Verification of Vehicle form

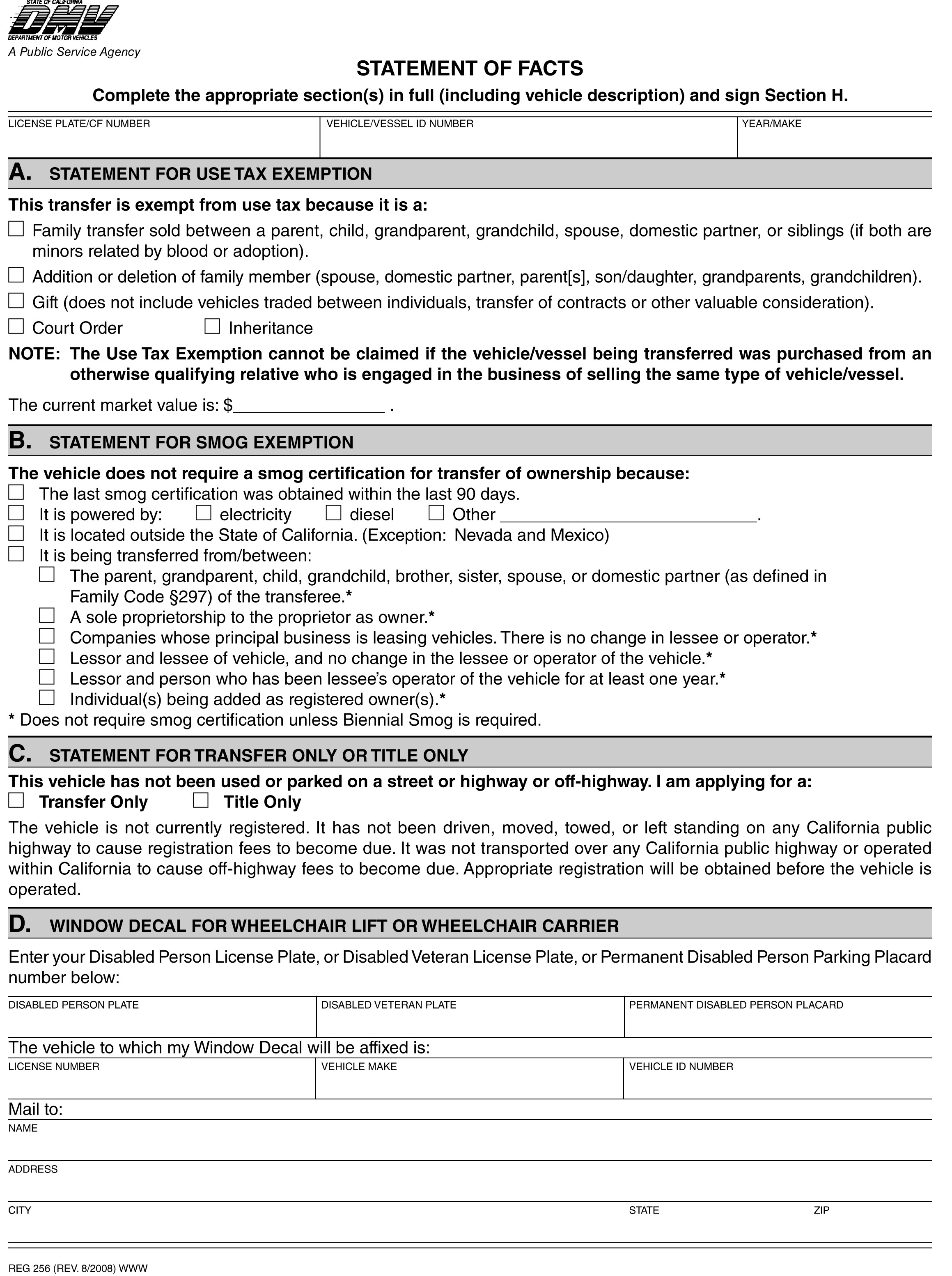

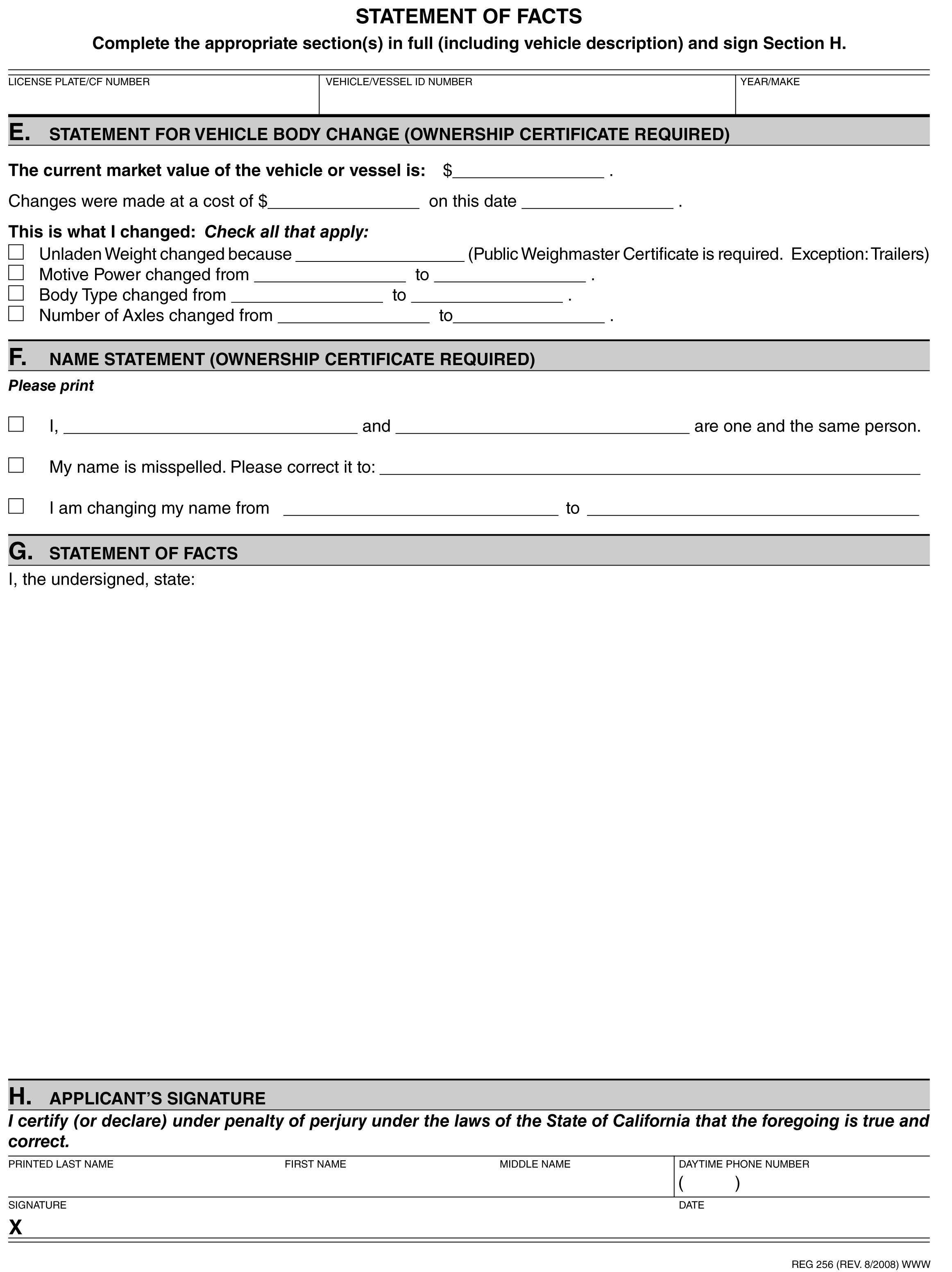

Step 3: Statement of Fact

The Statement of Facts form should contain the following information once it has been printed:

Step 4: Weight Certificate

Determine if your transaction requires a Vehicle Weight Certificate. Use this Declaration of Gross Vehicle Weight / Combined Gross Vehicle Weight link to get your prepared form.

Step 5: Purchase Your Title Bond

Your Title Bond will need to be to equal the determined value of your vehicle. For example, if your vehicle is found to be valued at $2000 then your Title Bond amount will need to be of an equal amount. Bonding fees are generally $150 for the first $5000 of bond value and $35 for each additional $1000. When you're ready, Contact Us, and we will gladly help you secure your Title Bond.

Step 6: Finalize Your Service

You'll need to take all your paperwork plus your CA Title Bond to your local DMV and pay the proper tax, title, and license fees. If your paperwork is approved, you will be issued a CA Bonded Title.

Tax, Title, and License Fees

Here are some of the factor that go into the calculation: vehicle purchase price (if it's a gift there's no use-tax applied but you need to complete a Statement of Facts Form - REG 256 attesting it), sale date, parking/toll violations, registration address city/county, and any special plate requests.

Use Tax – Between 7.5% - 10%. Taxes are collected by the county in which you indent to register your vehicle.

Transfer Fee – $15.00 or $20.00. DMV fee charge to perform a title transfer. $20.00 for out-of-state vehicles.

Registration Fee – Does not apply in all cases. Read about registration fees in the paragraph below.

Note: You won't always be required to pay California vehicle registration fees. Registration fees (along with the other fees mentioned below) are only due if the vehicle you purchase or acquired has expired registration or registration which is about to expire (75 days or less). If renewal fees are due for the vehicle, the DMV will require you to pay registration fees on top of the sales use tax and transfer fee. The registration fee will include various county fees, vehicle licensing fee (VLF) equal to 0.65% of the vehicle's value, and a California Highway Patrol (CHP) fee. Here is an itemized list of California vehicle registration fees:

DMV Registration Fee - $46.00 for initial registration/renewal.

Vehicle License Fee (VLF) - Based on .65% of the value of your vehicle.

Weight Fee - Applies to commercial vehicles. Determined by weight.

County/District Fees - Between $7.00 and $47.00 depending on the county in which your vehicle is registered.

Smog Abatement Fee - $20.00. Applies to vehicles which do not require a smog inspection.

Owner Responsibility Fee - $7.00 fee for failing to appear on a citation, if applicable.

CHP Fee - $24.00 authorized under CVC 9250.8, 9250.13, and 9552–9554).

Fees collected are distributed as follows: 40.7% to local government (cities/counties), 25.7% to the CHP, 13.9% to the DMV, 13.0% to Caltrans, 1.7% to the California Air Resources Board, 4.3% to other state agencies, and 0.7% to the general fund.